By: Ritu Bhandari, Aashish Chandorkar and Nimish Joshi

Date: June 14, 2021 | 12:44 PM

Digital revolution has truly hit payment systems in India. UPI (Unified Payments Interface) and IMPS (Immediate Payment Service), the two fast payments, have revolutionised real-time payments in India.

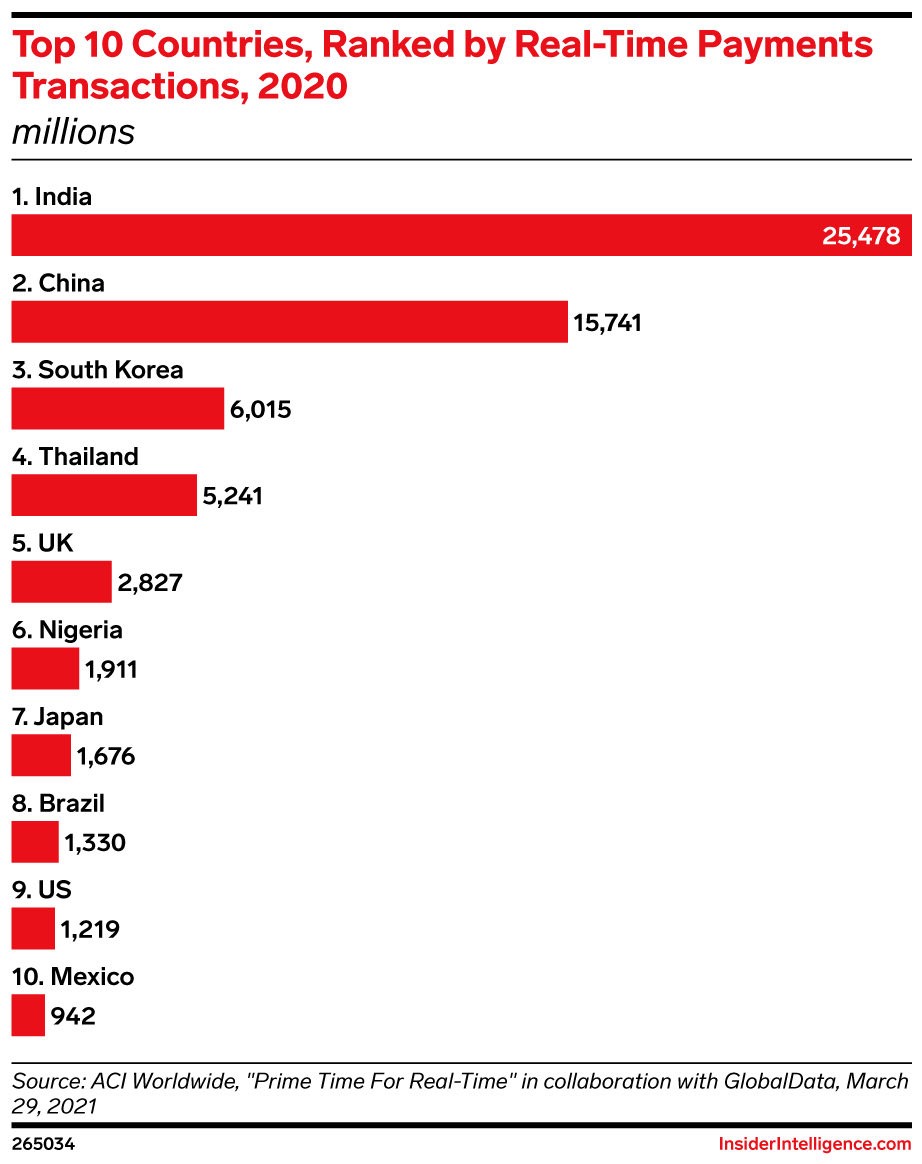

India, with 25.5 billion* transactions, topped the list of countries with the most number of real-time transactions in digital payments in 2020, followed by China (15.7 billion) and South Korea (6 billion), according to the report Prime Time for Real Time-2021, launched by ACI Worldwide and GlobalData.

Globally, the total number of real-time transactions in 2020 was 70.3 billion, an increase of 41%, compared to 2019 (50 billion). The value of real-time transactions increased by 33% from $69 trillion in 2019 to $92 trillion in 2020.

UPI and IMPS, the two systems together handled 83.5 million transactions on a daily basis for a value of Rs 228.5 billion (Rs 228,500 crore) in December 2020. The real-time transaction volumes in India have more than doubled while the value has increased by 80%, over the previous year.

Peer-to-peer (P2P) accounted for about 60% by volume and 85% by value of all UPI transactions, while peer-to-merchant (P2M) accounted for the balance (as per December 2020). Average ticket size in UPI is Rs 1,700 and IMPS Rs 9,000.

India had launched IMPS for online payments below Rs 2 lakh, in 2010. IMPS has grown from Rs 1.6 trillion in FY16 to Rs 23.4 trillion (Rs 23.4 lakh crore) in FY20, recording a CAGR of 95%.

The launch of the indigenously developed UPI, a platform for making payments between any bank and smartphone app, in 2016, is a watershed moment for the digital payments industry.

Till the launch of UPI by the National Payments Corporation of India (NCPI), banks were the sole provider of digital payment services in India. However, the launch of UPI and entry of Third-Party Application Providers have disrupted digital payments in India. UPI’s ease of transacting and easy accessibility has made it an instant winner.

UPI transactions have been growing at a breakneck speed with about 100 million (10 crore) active UPI users. Launched in 2016, UPI crossed 1 billion transactions for the first time in October 2019.

While it took UPI three years to reach a billion transactions in a month, the next billion came in just a year. The transactions crossed the 2-billion mark in October 2020 and crossed Rs 4 trillion (Rs 4 lakh crore) in value in December 2020, as against Rs 21 trillion (Rs 21 lakh crore) in FY20. At this pace, UPI transactions can be expected to reach Rs 48-50 trillion (Rs 48-50 lakh crore) annually.

Source: NPCI

The launch of UPI has seen the entry of TPAPs such as Google Pay, PhonePe, Amazon Pay, WhatsApp Pay et cetera and PayTm Payments Bank app that facilitate UPI transactions between a user’s smartphone and banks.

There are over 20 TPAPs in UPI. The top 3 players account for 94% of UPI market share by value and 90% by volume (as per December 2020); PhonePe 44% by value, Google Pay 42%, PayTm 7.5%.

In order to acquire scale in customers and merchants, the top players in UPI spend aggressively on marketing and advertising through promotional offers, huge cash-backs, discounts, celebrity endorsements and big event sponsorship (e.g. IPL 2020).

While this has resulted in exponential growth rate in UPI transactions and massive growth in user base, it has resulted in whopping losses for the companies.

The waiver of MDR (merchant discount rate) on UPI has also hit the revenue model. In a bid to increase merchant adoption of digital payments, the government had abolished MDR on UPI, with effect from December 30, 2019.

However, abolition of MDR on UPI has disincentivised the banks in investing in technological upgrades in the face of exponential growth in throughputs and thereby increased transaction failures.

India has built an expansive, secure, efficient and scalable public digital infrastructure – India Stack (Aadhar, UPI, e-KYC, e-signature among others), which is paving the way for a massive world-leading digital payments revolution.

India, as a digital pioneer and global leader is well positioned to help other countries emulate our efficient digital platforms such as Aadhar, UPI, RuPay and other such innovations.

While India continues to have a cash bias, macro-events such as demonetisation in 2016 and the current Covid-19 pandemic, have shifted consumer preference towards digital payments in a big way.

Behaviour also changes based on the age of the transactor: the younger generations in India prefers to pay more digitally, while the older generation prefers cash payments and cheques.

India is a young country with a median age (27.9 years in 2019), resulting in a rapid adoption of digital payments. India has large and widespread cheap smartphone penetration with some of the lowest wireless data rates, which has helped digital payments.

NPCI has played a pivotal role as India continues to innovate with contactless, offline payments and new use cases of UPI.

With interoperability, the cornerstone of RBI’s regulatory approach, it has been ensured that payment solutions can be used across the system participants.

While we have witnessed the adoption of digital payments in metro and tier-1 cities, the real opportunity and economic benefit lies in its uptake in semi-urban and rural areas of the country.

Only about 100 million active users use digital payments and therefore, concerted efforts will need to be made to further increase adoption of digital payments in India.

Third party apps are the best examples of public-private partnership and underscore the importance of FinTech in the payments’ ecosphere.

* 1 billion = 100 crore; 10 million = 1 crore; 1 trillion = 1 lakh crore; 1 lakh = 100,000